07 August 2025 | Thursday | Analysis | By editor@biopharmaboardroom.com

( This news story is developing.)

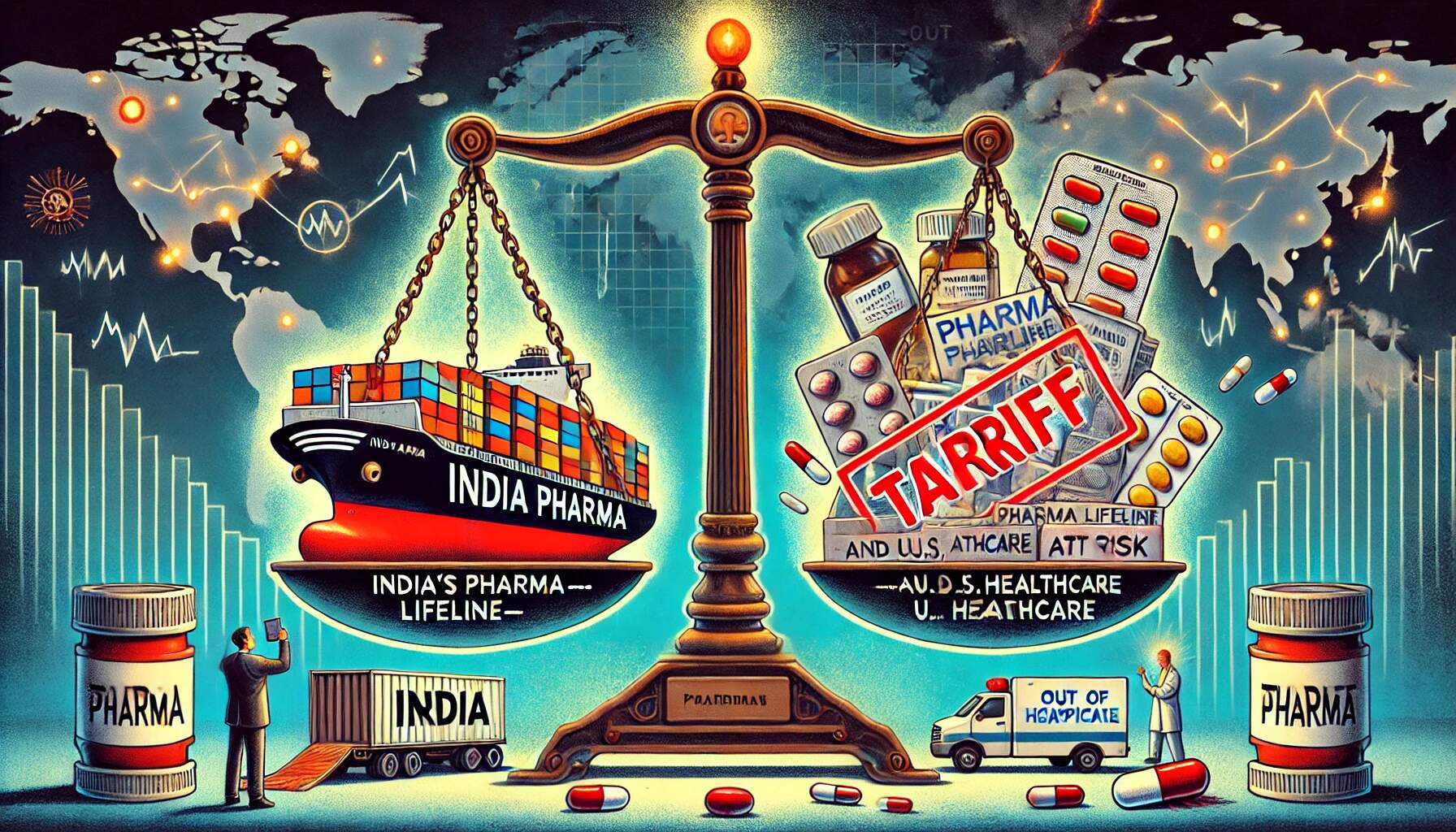

The U.S.–India trade relationship entered dangerous new territory as former U.S. President Donald Trump announced on 5 August 2025 that pharmaceutical imports may soon face tariffs of up to 250%, building on an earlier 25% tariff imposed on Indian goods just days prior. Though pharma was not immediately included, the signal was loud and clear.

India, which supplies approximately 40% of the U.S.'s generic medicines, plays a critical role in delivering affordable treatments—from antibiotics to cancer therapies—across the American healthcare system. Now, that lifeline is under threat. Indian pharma stocks have already begun to feel the tremors, and industry experts warn that these punitive measures risk disrupting essential medicine supplies, inflating costs, and undermining years of bilateral goodwill.

On 1 August 2025, the United States officially imposed a 25% tariff on Indian imports, citing India’s sustained energy ties with Russia and persistent trade imbalances. Though pharmaceuticals were not immediately carved out from this initial wave, the industry now stands precariously exposed—particularly after Trump’s 5 August 2025 remarks hinting at pharma-specific tariffs scaling up to 250%.

India supplies roughly 40% of generic drugs to the U.S., including vital medications such as antibiotics, oncology drugs, antiretrovirals, and insulin analogues. These form the backbone of essential care for millions of American patients.

The potential disruption is not theoretical: on 31 July, Indian pharma shares including Dr. Reddy’s, Cipla, and Sun Pharma saw dips of up to 3%, reacting to growing concerns over the structural threat to exports.

Industry leaders in India have unequivocally labelled the proposed 200–250% pharma tariffs as “absurd and self-defeating.” Their argument is both economic and humanitarian:

“These are not luxury products. These are essential medicines. You cannot tariff your way out of a public health necessity.”

— spokesperson, Indian Drug Manufacturers’ Association (IDMA)

Key concerns raised by experts include:

Supply Chain Fragility: Tariffs would increase the cost and delay the availability of first-line treatments for chronic illnesses like hypertension, diabetes, cancer, and HIV.

Public Health Risk: U.S. healthcare systems, especially in rural and low-income areas, rely heavily on cost-efficient generics to maintain public health programmes.

Redundant Redundancy: Even if U.S. domestic production is revived, the scale, speed, and cost-efficiency of Indian pharma cannot be immediately replicated without years of infrastructure and regulatory realignment.

Despite these concerns, Indian pharma continues to exhibit strong global demand traction, resilient regulatory track records, and cost structures that make it difficult to displace in the medium term (The Times of India).

| Date | Milestone/Event |

|---|---|

| 30 July 2025 | U.S. enacts 25% tariffs on Indian goods, citing Russian oil policy and trade imbalance (PBS, Washington Post). |

| Late July–Aug 2025 | Trump warns of pharma tariffs reaching 200%, to be phased in over 12–18 months (Fierce Pharma, Business Standard). |

| 5 August 2025 | Announces initial pharma duties, with plans to escalate to 150% and 250%, aimed at reshoring drug manufacturing to the U.S. (Reuters, NDTV, ABC). |

The U.S. and India had set sights on a $500 billion bilateral trade goal by 2030, reinforced by PM Modi’s visit to Washington in February 2025. The imposition of tariffs jeopardises this progress, injecting strategic mistrust into a once-strengthening partnership (Wikipedia).

While India’s pharma sector is geographically diversified—with growing footprints in Africa, LATAM, ASEAN, and Europe—a prolonged tariff war may lead firms to:

Explore joint manufacturing in the U.S. (to bypass tariffs)

Accelerate regulatory submissions in alternative markets

Challenge the tariffs at the WTO under non-discriminatory trade principles

As noted by Barron’s, if pharma tariffs go forward, the U.S. healthcare system could face:

Rising treatment costs, especially for chronic illness management

Delayed drug availability, particularly for hospitals relying on bulk procurement

Strain on Medicaid/Medicare budgets, which are sensitive to even marginal drug price shifts

The 5 August announcement is more than a negotiating tactic—it is the opening salvo of a strategic decoupling effort aimed at reshoring critical industry infrastructure. However, the pharmaceutical sector is not merely a trade commodity—it is a lifeline for millions, and any disruption has immediate clinical implications.

India, for its part, is well-positioned to weather this storm, thanks to:

An agile and compliant manufacturing base

Global regulatory recognition (USFDA, EMA, WHO PQ)

And a price-quality competitiveness that’s difficult to replicate

“The bigger risk isn’t to India. It’s to America’s own patients, who depend on quality generics at scale.”

— Senior Analyst, Indian Pharmaceutical Alliance

As the world watches this tariff chessboard unfold, one truth remains clear: essential medicines must not become pawns in geopolitical brinkmanship.

© 2026 Biopharma Boardroom. All Rights Reserved.